Frequently Asked Questions Our GST invoicing

Get instant answers to your questions about Billing Software, including the best options in India, GST invoicing, E-Invoicing, E-Way billing, and more.

1. What is MyCashBook?

MyCashBook is a comprehensive billing software designed to streamline finance management and ensure GST compliance for small & medium businesses in India

2. What features does MyCashBook offer?

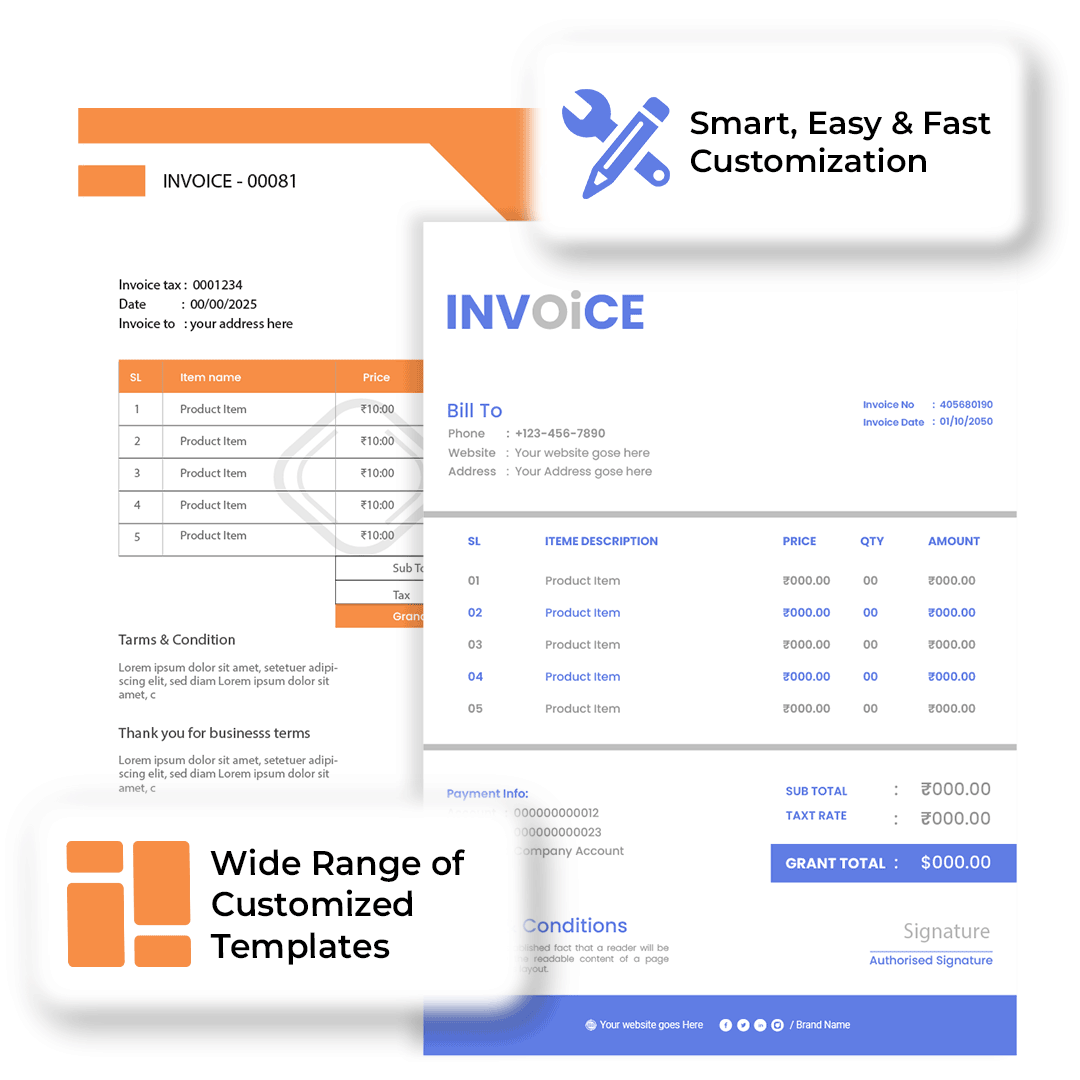

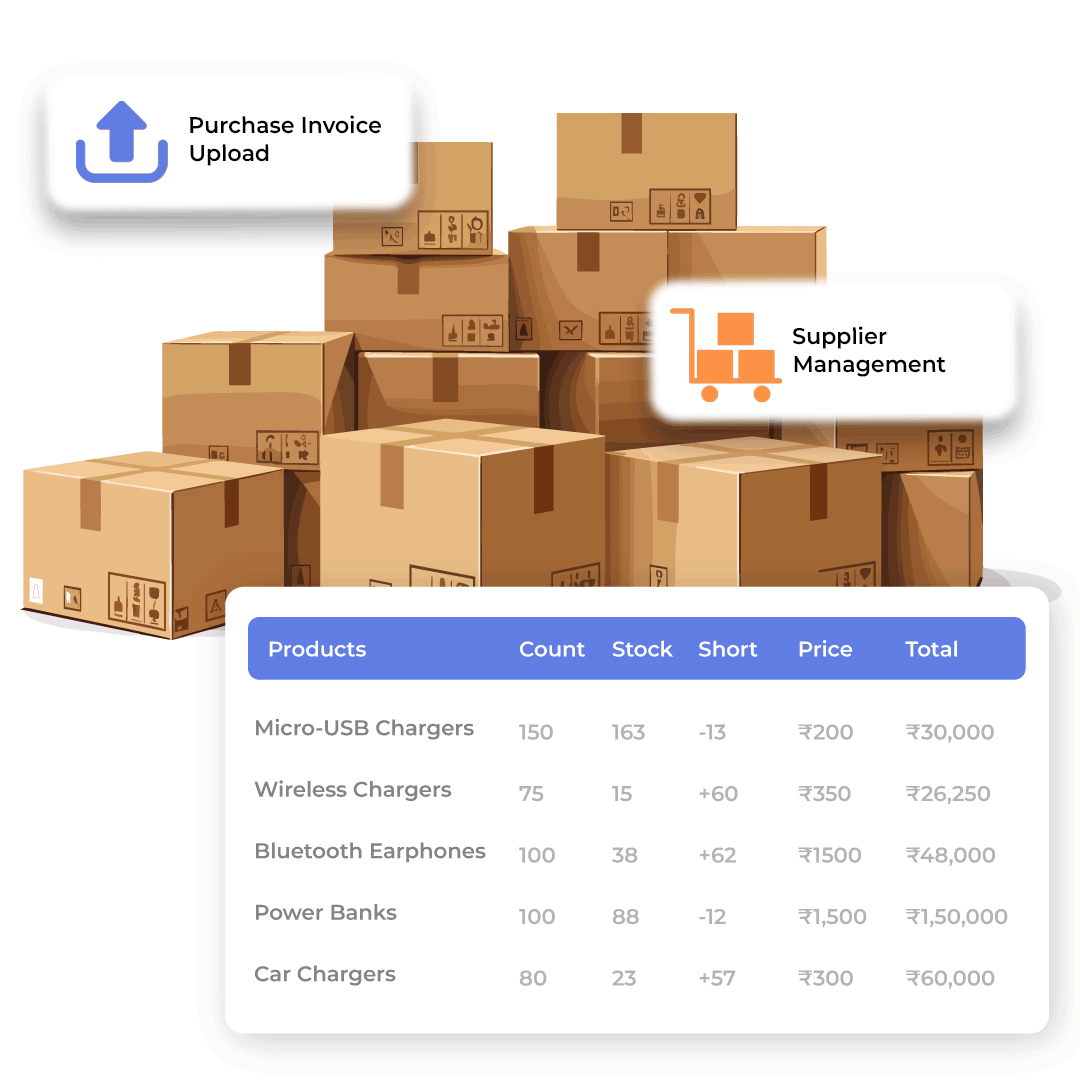

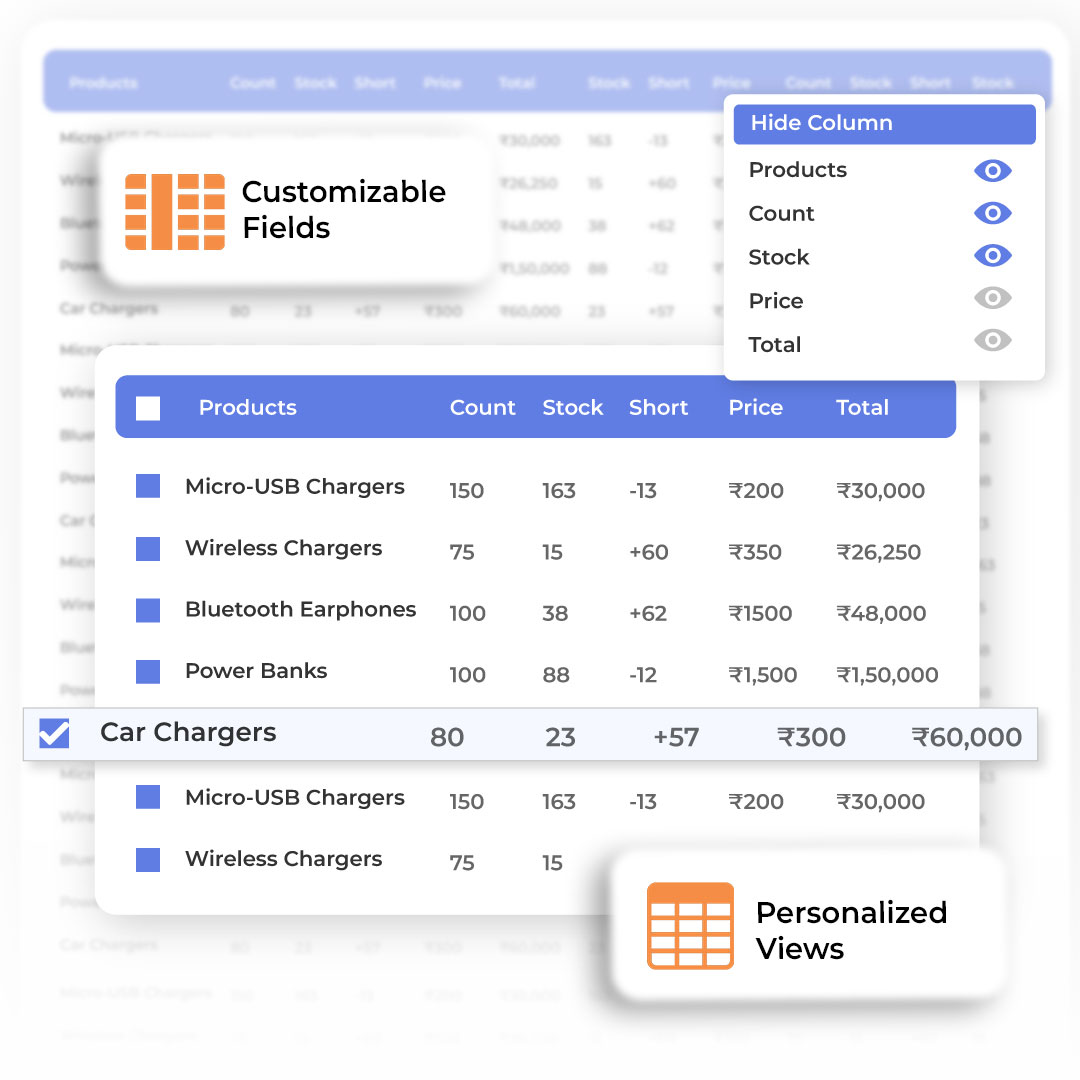

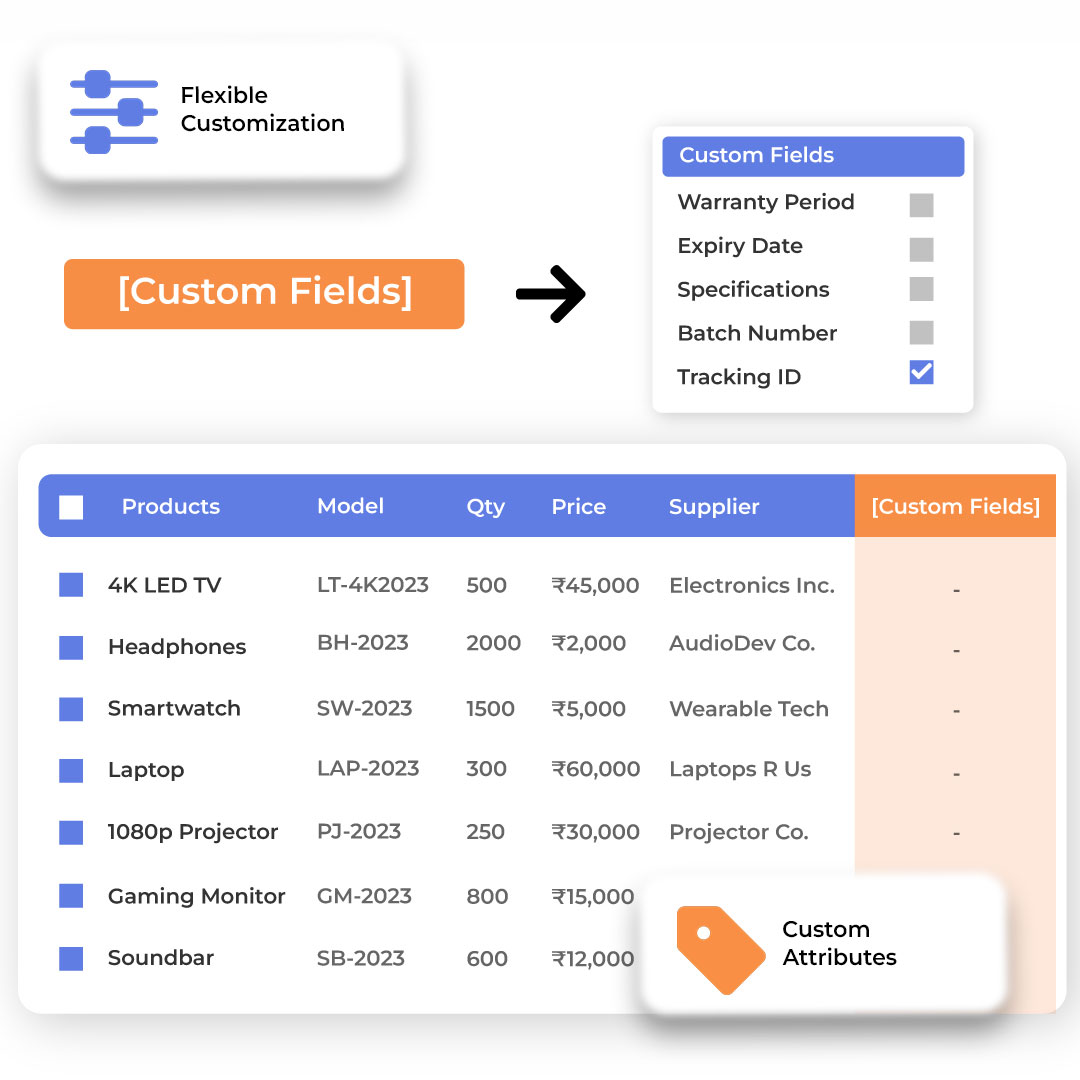

MyCashBook offers a range of features including GST invoicing, E-Invoicing, E-Way billing, customizable invoicing templates, expense tracking, and reporting.

3. What are the benefits of using GST billing software?

Automates invoicing tasks, saving time and minimizing errors.

Ensures accurate calculations, reducing invoicing errors.

Speeds up invoicing processes with automated templates and workflows.

Organizes client information, invoices, and payment records for management.

Provides customizable invoice and branding options for a professional appearance.

Generates reports and offers insights into financial data for improved analysis and decision-making.

Ensures compliance with GST tax regulations.

4. Can I try MyCashBook before purchasing?

Yes, MyCashBook offers, you can experience its features and benefits before making a decision.

5. How can I get support for MyCashBook?

MyCashBook provides comprehensive customer support via email, phone, and online chat to assist you with any queries or issues you may encounter.

6. How does MyCashBook ensure data security?

MyCashBook employs robust security measures to safeguard your data, ensuring it remains protected at all times.

7. Which billing software is best for small, medium businesses?

We understands the billing and accounting needs of small businesses better than another small business that has designed

India's No.1 billing and accounting? Yes, MyCashBook was designed & developed by for all the small, medium business owners in India. the GST invoicing software has been rated one of the best billing software for small, medium businesses in India.

8. How to use Gst/Billing software?

Using billing software can vary depending on the specific program you're using. Whether it's on-premise or cloud-based, the instructions may differ. For MyCashBook, exploring the version and assessing the user

interface is recommended. If you face any difficulties, our customer service team is always available to provide assistance and ensure a seamless experience.

Hardware

Hardware Logistics

Logistics Mobile Accessories

Mobile Accessories Hotel

Hotel  Automobile

Automobile General Store

General Store Electronics

Electronics FMCG

FMCG Garment

Garment Pharma

Pharma Jewelry

Jewelry Construction

Construction